This blog is the second in our series that breaks down our key findings from our TCFD Global Progress Report for the banking sector, published in March 2021. See our first post on climate governance here.

The Task-Force on Climate-Related Financial Disclosures (TCFD) has fast become the global standard for reporting climate-related risk and opportunities.

In this blog, we explore our analysis of climate risk management and how banks can improve their response to the TCFD’s three recommended disclosures to ‘Disclose how the organisation identifies, assesses and manages climate-related risks’:

- Describe the organisation’s processes for identifying and assessing climate-related risks;

- Describe the organisation’s processes for managing climate-related risks;

- Describe how processes for identifying, assessing and managing climate-related risks are integrated into the organisation’s overall risk management.

How does climate change introduce additional financial and operational risk to banks?

Climate change presents additional risk to an organisation via two main forms:

- Physical risks – increasing severity and frequency of climate and weather-related events, e.g. increased flood incidence, severe droughts;

- Transition risks – structural changes made in the transition to a low carbon economy, e.g. shifts in consumer behaviour, technological change, climate-related policy and regulation

These risks drive additional risk in conventional banking risk-types – credit, market, liquidity, operational and liability – through various transmission mechanisms. For example, increased severity of weather events may damage the assets of a large counterparty, impacting their ability to re-pay a loan and having repercussions on the balance sheet of the lender. Therefore, leaving this risk unmanaged may have severe financial consequences for financial services organisations and, more importantly, for global financial stability. According to research published by the London School of Economics an average of US$2.5 trillion of the world’s financial assets would be at risk from the impacts of climate change if global mean temperature rises by 2.5°C above its pre-industrial level by 2100. Banks thus need to be able to identify, measure and manage these risks as they develop over time, and embedding them in the existing risk management framework of an organisation is critical to this.

The importance of this is also highlighted by the regulator. In their ‘Dear CEO’ letter, offering thematic feedback from the review of firms’ SS3/19 plans, the PRA actively encourages firms to follow the guidance set out in the TCFD, identify the potential financial impact of climate-related issues, and assess the resilience of their business strategy.

Moreover, shareholders and customers are also entering the fray to demand more robust, transparent climate risk management. A spate of high profile statements and news stories over the past year demonstrate investors – including some of the world’s largest asset managers – and consumers alike becoming increasingly unwilling to transact with organisations with a bad record on climate. For example, BlackRock recently backed a shareholder resolution for BP to accelerate climate action, whilst Legal & General announced they would exclude four companies from their funds because of their insufficient response to climate change.

In this context, banks can and should use the recommendations in the TCFD framework to develop and demonstrate their approach to climate risk management, meeting the clarion call from these three key stakeholder groups to demonstrate progress now.

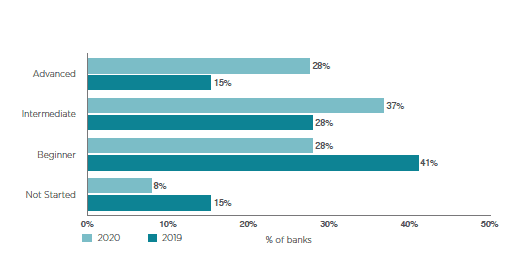

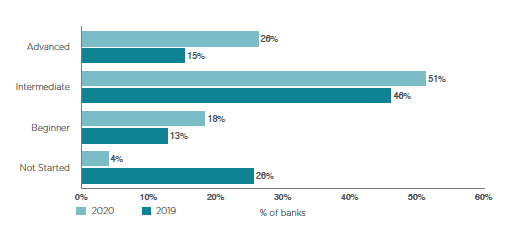

Encouragingly, the maturity of reporting across the three TCFD recommendations has increased since 2019, with:

- 65% of firms in the ‘advanced’ and ‘intermediate’ stages of reporting on transition and physical risk;

- 77% of firms in the ‘advanced’ and ‘intermediate’ stages of reporting transition and physical risk on the Risk Management framework.

Figure 1: Transition and Physical Risk

The majority of existing disclosers are evidencing key considerations underpinning climate risk management within their organisations. Several banks in the ‘advanced’ stage evidence the development of climate risk heatmaps by sector and geography that integrate the impact of physical and transition risks under a range of scenarios. This information is being considered in portfolio sector allocation and in defining enhanced sector-specific screening standards.

There is also increased evidence of climate risk’s integration in credit rating assessments. Several banks are starting to integrate climate risk factors into industry risk ratings that feed internal counterparty rating models. More-advanced banks reference a broad range of internal tools and technology solutions that assess climate risk.

In contrast to the results observed in existing disclosers, new disclosers are often still in the early stages of development, with 57% of banks in the ‘beginner’ or ‘not started’ stages. New disclosers typically acknowledge plans to include climate considerations in the risk appetite statement, integrate standard climate risk assessments in risk management processes, and highlight examples of risk factors that are being considered.

Figure 2: Risk Management Framework

There has been progress in the integration of climate risk into enterprise frameworks.

More-mature banks detail specific cross-team climate responsibilities and outline key processes underpinning climate risk management in their disclosures. Examples include environmental screening of proposed investments/funding projects, periodic monitoring, and enhanced due diligence standards for review and approval of climate-sensitive transactions. Banks often reference the use of third-party tools to complete client environmental screening. Several banks reference the creation of dedicated teams with deep expertise in climate risk to support risk assessments, particularly for carbon-sensitive sectors including fossil fuels, forestry, and mining.

However, despite the progress made in the sector, challenges remain regarding the availability of data and tools to develop and measure quantitative risk appetites and thresholds. This is particularly evident in scenario analysis capabilities and the lack of integration of these in risk management processes. Furthermore, there remains a sizable proportion of banks that are yet to disclose evidence of integrating climate risk in their risk management framework.

For UK regulated banks, the PRA has set-out several expectations on climate risk management to be met by end-2021 (see Supervisory Statement 3/19), much of which aligns to the TCFD framework. We anticipate that further developments in maturity will be made because of this regulatory push, with some organisations needing to do more than others.

How can banks reach the next level?

Less mature disclosers

Institutions that are starting to implement the TCFD recommendations should focus on enhancing their existing risk appetite statement to take climate into account, and ensure climate risk considerations are integrated in their wider enterprise risk framework.

| Recommendation | Example |

| Disclose key controls that are utilised to manage climate risk in line with strategy and risk appetite. | Integrate climate considerations in client level, sector-level, and third-party risk assessments, including early warning indicators, rating models, covenant management, Risk and Control Self Assessments (RCSAs), and event management. Integrate climate in the operational resilience framework. |

| Engage with clients in an advisory capacity to develop their climate strategy and to enhance counterparty data gaps. | Introduce client questionnaires to identify counterparty risks and assess clients’ response to climate change. |

| Provide evidence of transaction reviews and tools used to measure and monitor climate risk. | Collate and disclose the number of transactions subjected to enhanced climate-related due diligence checks during the financial period, including details of the number of transactions approved, rejected, etc. |

More mature disclosers

Institutions that have already started to embed TCFD can focus on disclosing their key controls for managing climate-related risk engaging with clients to develop their climate strategy, and disclosing volumes of climate-risk related transaction reviews.

| Recommendation | Example |

| Ensure the risk appetite statement for the organisation embeds climate risk considerations. | Develop and enhance existing quantitative and qualitative risk appetite statements in relation to climate based on the key risks identified, strategic planning considerations, and initial stress testing results. |

| Integrate climate risk into the wider enterprise risk framework | Assess how climate risk can be embedded in existing risk management processes for traditional risk types (e.g. credit, market, liquidity, operational), and agree and document key responsibilities in relevant processes and risk framework documentation. |

Conclusion

Climate risk management in the banking sector is improving, but there is still significant room for enhancement.

Our recommendations provide banks with practical next steps to implement robust climate risk management in line with the TCFD recommendations. With PRA expectations for the end of the year in mind, implementing these recommendations will go a long way to supporting organisations’ response (see PRA Dear CEO letter: Managing climate-related financial risks).

Ultimately, managing climate-related risk is critical to ensure the resilience of organisations’ business strategy. Embedding climate risk into the risk management framework is the key to this and needs to be at the top of the agenda across the sector, not just to meet regulatory and stakeholder demand, but to future-proof business models for an increasingly climate-conscious world.

For further information on Governance, Risk Management, Strategy and Metrics and Targets disclosure findings, best practice and recommendations please see our full report.

[1] To evaluate progress in the quality of Risk Management recommendations in line with the TCFD recommendations, as part of our methodology we have segmented and categorised the TCFD Risk Management recommendations in two themes: “Transition and Physical Risk” and “Risk Management Framework”. We also have developed a maturity assessment methodology to rank the level of progress as either not started, beginner, intermediate, or advanced.

Dan Ridler

Managing Director, BCS Consulting

t: +44-20-7648-2053 | m: +44-7971-833236

w: bcsconsulting.com