by Pierre Pourquery, Head of Capital Markets UK and Emanuel Vila, UK Capital Markets Consultant, EY UK

As returns fall and costs stay high, the challenge for investment banks is not IF they need to partner with others, but HOW. EY Head of Capital Markets UK, Pierre Pourquery and Emanuel Vila the UK Capital Markets Consultant, explain the different partnership models available and the substantive benefits they can bring to investment banks.

1. Once too big to fail are now becoming too small to survive

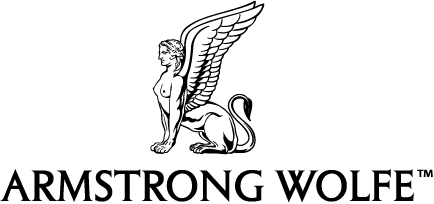

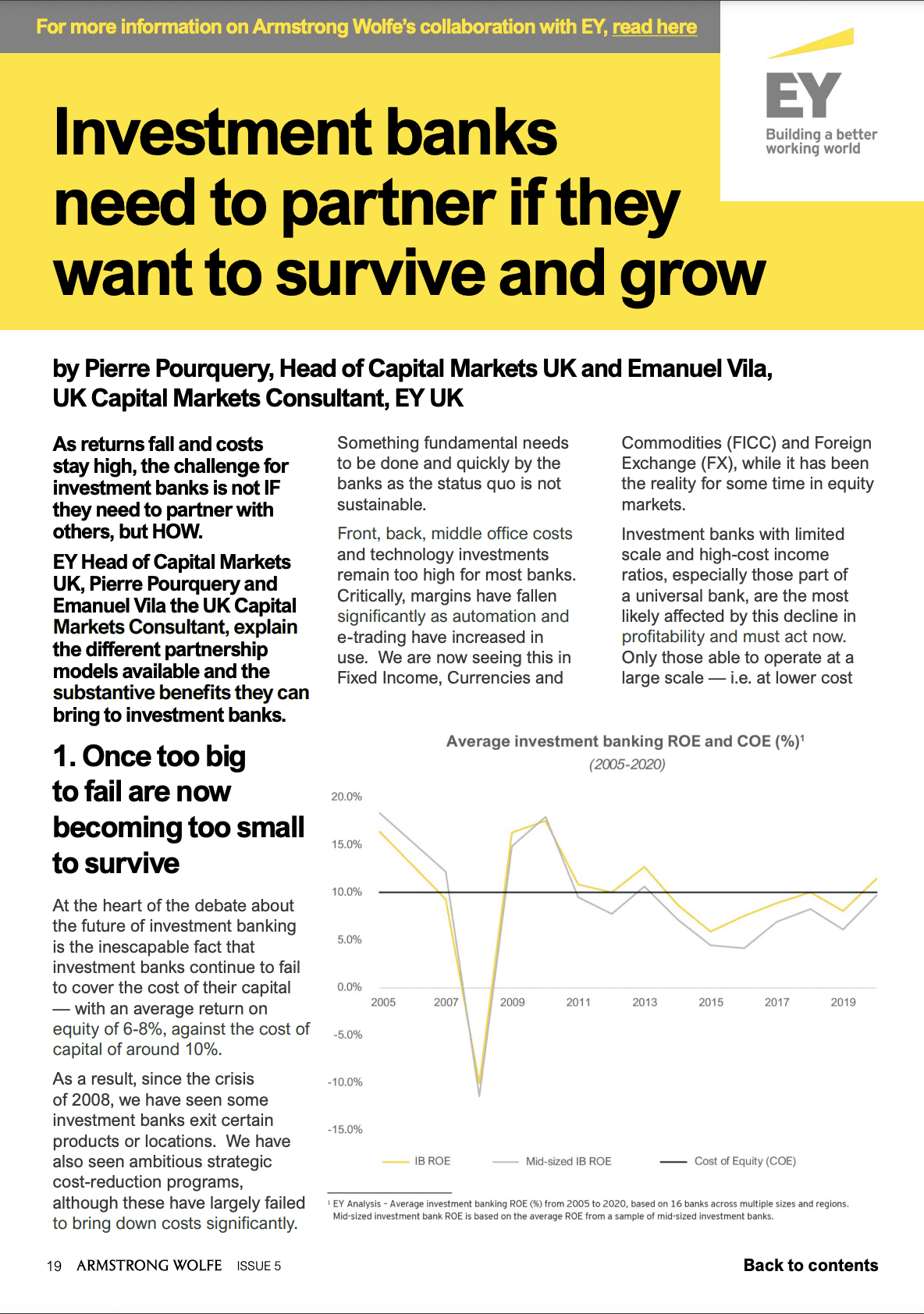

At the heart of the debate about the future of investment banking is the inescapable fact that investment banks continue to fail to cover the cost of their capital — with an average return on equity of 6-8%, against the cost of capital of around 10%.

As a result, since the crisis of 2008, we have seen some investment banks exit certain products or locations. We have also seen ambitious strategic cost-reduction programs, although these have largely failed to bring down costs significantly.

Something fundamental needs to be done and quickly by the banks as the status quo is not sustainable.

Front, back, middle office costs and technology investments remain too high for most banks. Critically, margins have fallen significantly as automation and e-trading have increased in use. We are now seeing this in Fixed Income, Currencies and Commodities (FICC) and Foreign Exchange (FX), while it has been the reality for some time in equity markets.

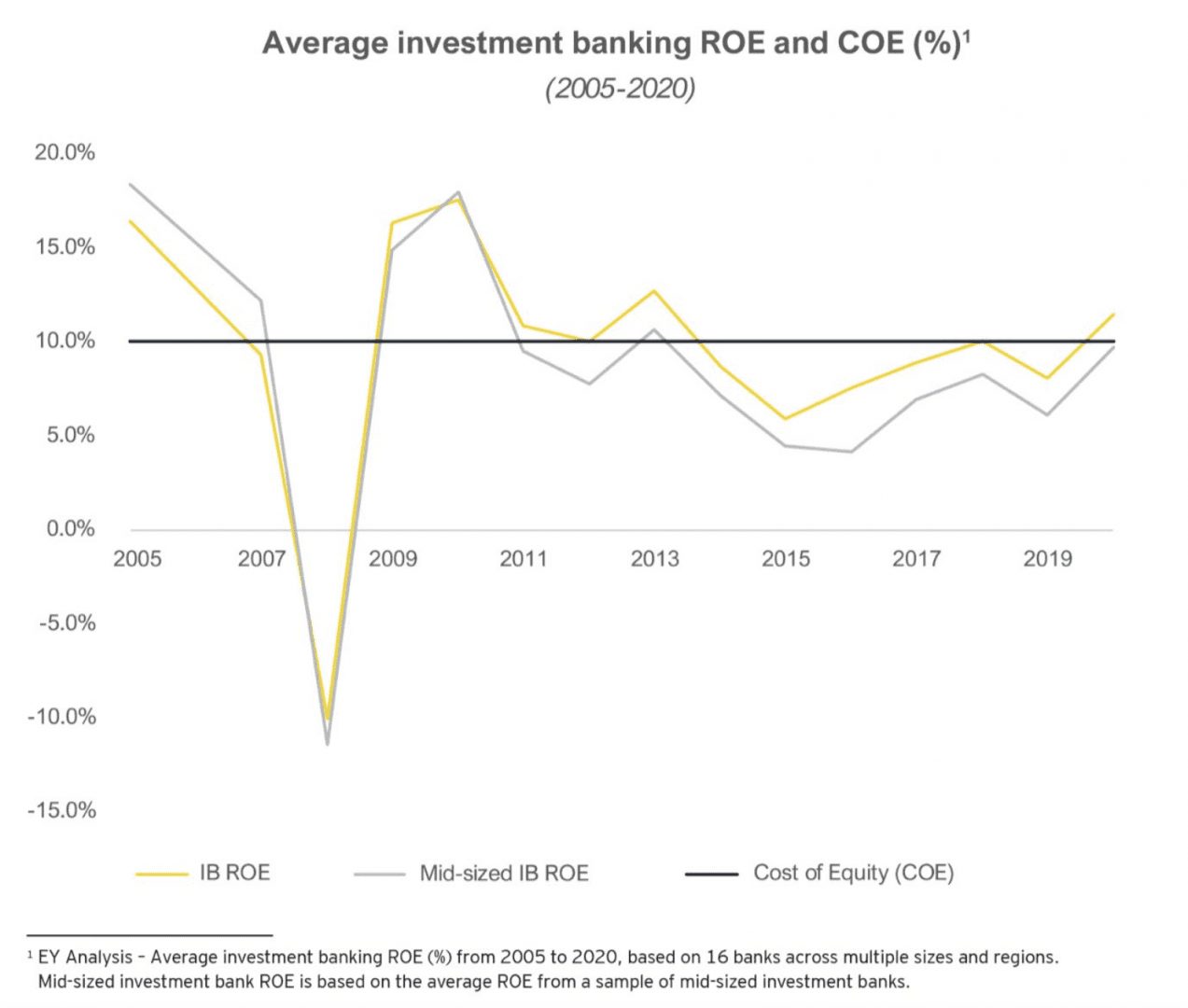

For the majority of other investment banks, developing industrial partnerships, in the form of outsourcing, is probably the only way to continue their activities and to provide clients with the right breadth and quality of products. Without scale or outsourcing, they genuinely face being too small to survive.

We have seen strong financial performances in 2020, driven by market volatility. This has led to some temporary improvements in ROE, tempting some banks to shift their focus away from cost-reduction in the very short term. However, banks shouldn’t be deceived by these short-term gains. The reality is they still face fundamental challenges (regulatory driven costs, intensifying competition, need for size and scale to price effectively, etc.) and partnerships will remain key to long-term success.

2. Cooperation not competition

Table 1 – A win-win for all parties

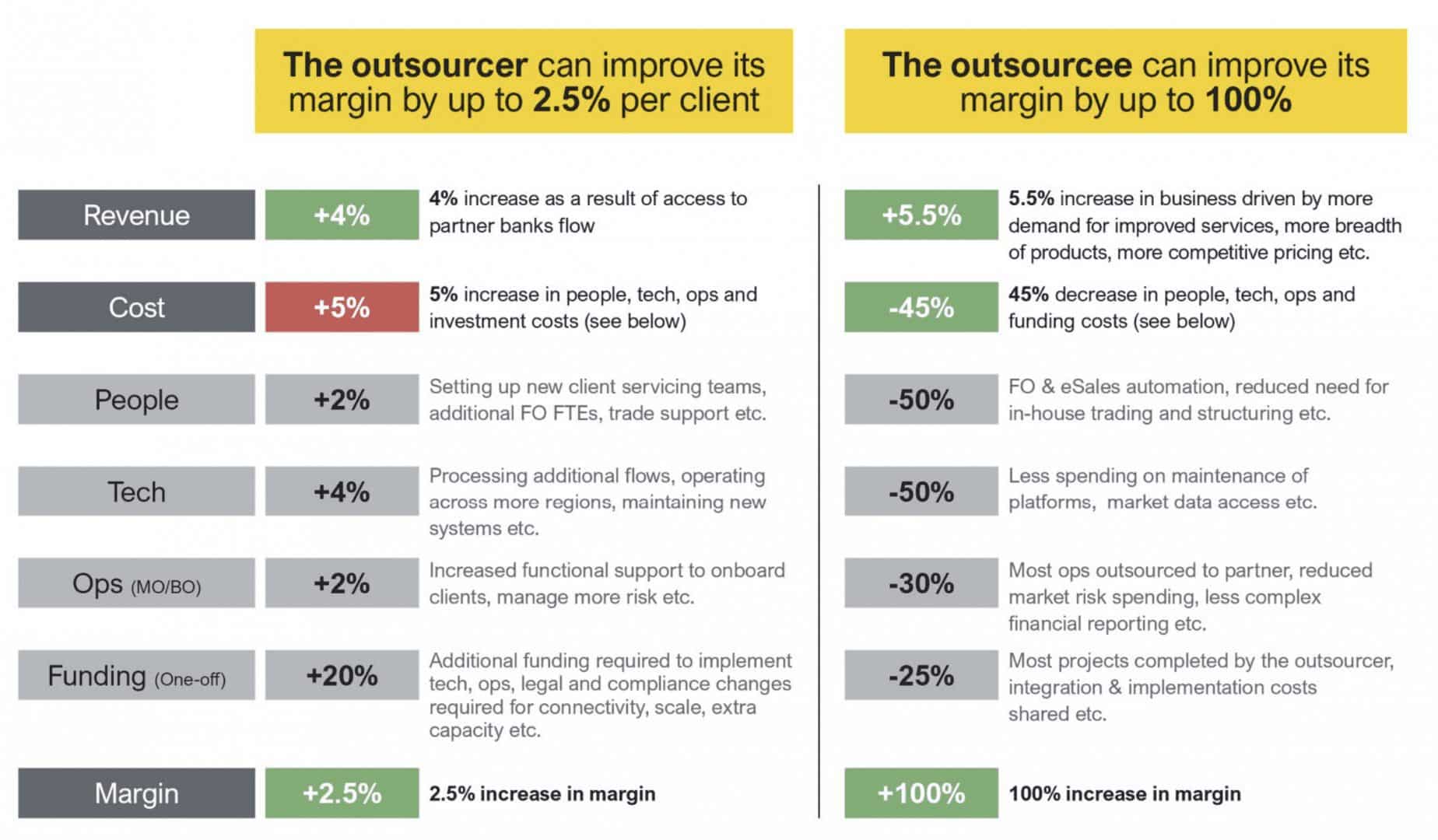

A partnership around outsourcing can benefit both sides (see Table 1). For the smaller bank, it means outsourcing a function or the entire value chain of their activities in which it is not competitive – this could include execution and front-office activities, to a third-party market player who is able to perform the same function at a lower cost and more effectively.

The impact could be genuinely transformative. By outsourcing instead of having their own infrastructure, banks could see costs reduce significantly as illustrated in Table 1. This could fundamentally change the viability and underlying economics of their services. It also means the banks can focus their limited resources on areas in which they already excel or wish to gain scale.

For the large bank, it provides extra revenue with low additional costs and capital requirements. It also helps them as part of a wider move away from relying on transaction fees, which are on a downwards trend, to more resilient service fees.

It is this win-win aspect that makes the rise of partnerships so compelling and inevitable. The question is when not if this occurs. To date, capital markets have lagged behind other sectors when looking at partnerships as they strived for innovation in products rather than service models. Retail banks, for example, already often outsource backoffice loan processing, to save costs and speed up the process. Partnerships are not only limited to the finance industry and are also evident across other sectors like Pharma, where established players outsource the manufacturing of treatments when they lack their own tech capabilities to manufacture in a cost-effective way, increasing their production capacities without any investment. We expect the next few years to see an exponential rise in the rate of partnerships within investment banking.

Of course, it is not just large banks that can step in. We have seen the rise of FinTechs, who have the technology to take advantage, as smaller banks look to outsource core activities, such as execution, post-trading processing, and back or middle office operations.

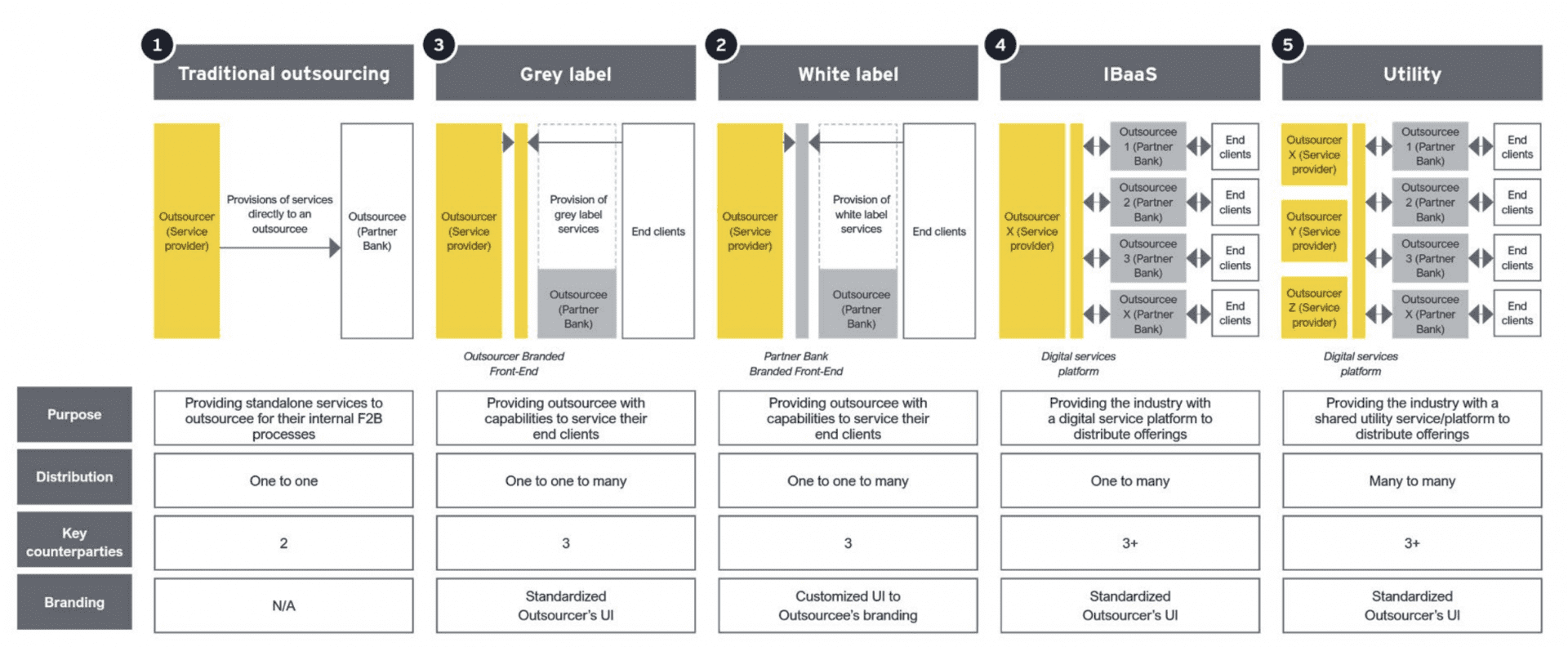

3. Five different outsourcing options

1) Traditional outsourcing

Using another firm’s existing technology, people, and processes to manage trade lifecycle processes for internal purposes (e.g. order book management). This is a one-toone relationship between two partners, with no end-client directly involved.

2) Grey label services

Using another firm’s existing technology capabilities, people, and processes to execute trade lifecycle processes (e.g. settlements) for their own end clients. Typically, the end client of the partner (outsource) is aware that a third party has delivered the service.

3) White label services

While the bank still uses another firm’s technology, people, and processes for their own end clients, the end client will not be aware of the use of a third party. This allows it to cut costs without losing its own unique branding and image. Given investment banks are keen to sustain their brand consistency we are seeing a high appetite for this model.

4) Investment banking as a service (IBaaS)

Sometimes known as the “Amazon model”, this is a digital services marketplace where market participants can plug in and make their products available to the wider ecosystem in a one-to-many relationship. Other banks can then pick and choose the relevant services available and then automate them internally into their own systems.

5) Utility model

Similar to the IBaaS model, market participants make their products available to the wider ecosystem via a digital services platform. However distinctively from IBaaS, in utility models, we observe a many-to-many relationship, whereby multiple service providers come together in a consortium to offer their modular services.

Unlike the first three options, the IBaaS and Utility models results in a distribution model where many banks can be customers of the service, while traditional outsourcing, grey label, and white label services are one to one bespoke models.

Whatever model they use banks need to be cautious. Poor outsourcing can harm a bank’s reputation or delivery of service. It can also expose misunderstanding of the true financial benefits or lack of an agreed pricing and tracking mechanism. Critically, banks also need to be ready to manage the transition and new arrangements in-house. They are importing a cheaper, more efficient system but also potentially importing risks – such as control of customers’ data.

4. Execution will not be easy

For bank executives, the strategy around the future of investment banking has been a difficult equation to resolve. It involves numerous factors such as legal, IT, operations, culture, regulation, profitability, and strategic plan. Trying to determine where and how to offer investment banking services, to find a sweet spot in terms of what’s easiest and most profitable has been very difficult. Partnerships could be a decisive factor in this consideration. From our experience and recent interaction with clients, there are some key decisions executives need to take:

1) Decide what products, markets, geographies and services the banks want to outsource: As well as products and geographical scope banks will need to be clear on what branding model they wish to pursue

2) Leveraging strengths as compared to Fintechs: Some Fintechs are eager to grab market share in the overall investment banking value chain. Although they may have superior technology and innovation capabilities, they cannot really cover the entire value chain – from front to back services. Large banks should therefore focus on providing integrated outsourcing solutions under the same umbrella. Their global reach and superior risk and control management are capabilities that are very difficult to match.

3) Be pragmatic and practical: Don’t invest huge amounts until you understand what the client wants. Perhaps choose two or three clients and test and learn before developing the next possible offering

4) Market more and earlier: Ensure marketing works in parallel to developing and building a solution. It cannot be left until the end as it takes time to establish a go-to-market framework, educate and train teams, establish funding, set sales targets, and develop marketing messages.

5) Always have a strategic blueprint in mind: While staying pragmatic is key, leaders also need to keep in mind the big strategic end picture, to ensure they have a clear roadmap for progress.

6) Understand the regulatory, risk, legal and compliance considerations: Understanding the detailed impacts and effects of the regulatory and legal environment is critical to ensure that both parties are clear about their legal liabilities and who is accountable for what along the outsourcing construct.

5. Partnerships will be a gamechanger

To ensure sustainability in the long run, it’s clear some investment banks will be better off focusing on certain areas, rather than competing across the full value chain and asset classes. Outsourcing may be the most visible sign of a new wave of partnership use in capital markets. Investment banks are now looking at partnership models to develop new ways of working. We expect to see a shift away from M&A and joint ventures to more digitally enabled, customer-centric, platform-based models that allow white label solutions.

Those who get it right will benefit from substantial cost savings, freeing up much-needed capital. They will also be able to provide a better level of service than competitors, using the latest technology, priced competitively. It may not return investment banks to the return on equity of the 2000s, but it will be a vital step in ensuring they are focusing on the most profitable parts of their business.

Partnerships could be critical in competing with Fintechs, which are increasing their role and market share in the banking industry; their presence in Capital Markets has been growing steadily in the last years. They leverage their tech platforms and talents to deliver services at a lower cost with service excellence in mind.

After years of fierce competition, some may observe the irony in partnerships being the platform for investment banks to thrive. But in times of declining profitability, increased competition with Fintech firms, and increased regulation, partnerships can free up capital and management time to ensure smaller investment banks can thrive, and not just survive.

Disclaimer: This Publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. Member firms of the global EY organization cannot accept responsibility for loss to any person relying on this article.

Pierre Pourquery

Head of Capital Markets UK

Emanuel Vila

UK Capital Markets Consultant, EY UK