“Career management and advancement are now the primary reason for the movement of COOs, and the entry point and the career opportunity are balanced against a feeling that many have found themselves in a career cul-de-sac.”

CAREER PROGRESSION AS A COO

A theoretical and moral requirement or practical impossibility?

Career management and how best to develop talent within the COO function have been the subjects of debate within banking for years. It is a question that anyone advancing a career within business management will ask themselves on occasion – and it is one that appears to offer no clear answer.

With the changing role of the COO and the growth of opportunities in business management since 2008, this subject demands investigation. To this end, I conducted back-to-back forums in London and New York in quarter four 2015 with over 50 COOs from 20 banks. The debate was a hearty one, and armed with this cross-industry, transatlantic representation, I was able to gain an insight into this complex subject. The findings outlined below are in themselves representative of market-wide opinion. The debate was set as follows:

Talent management within front-office business management

Fostering the future leadership of the markets’ COO community

How do you identify and develop today’s talent to become the commercial COO managing directorate of tomorrow?

The debate addressed the following questions:

1. What are the key/common components of the managing director, COO role today?

2. What are the common/required behavioural and technical competencies to be successful in this role?

3. Concluding 1 and 2, what therefore makes the difference between the competent and valued, but limited (e.g., lifetime director), and the one who can break through and establish him or herself at the higher level?

4. Can these competencies be used to frame selection of a VP (this will vary bank to bank, but targeted 10 years [+] commercial experience), as an entry into the business management community?

5. What talent pools might therefore be accessible/leveraged to source this VP talent?

6. How and what path could a VP entry hire be managed through to MD to produce the commercially competent executive COO?

One COO set the tone of the debate from the outset:

“Whilst I could summarise my thoughts in detail and talk for many an hour on this subject, having navigated my own career through business management for over twenty-five years, my short summary at this stage is that simply we do not have a uniform and/or structured approach to career management within the COO and/or business management community. We have tried to make one work, but such attempts seem to frustrate the ad hoc, meritocratic and opportunist career advancement which is at the heart of any career within business management. You make your own career, choose your patrons carefully, promote yourself, but define yourself by getting things done. The latter is your passport to career advancement.”

This proved to be a far-reaching statement at the beginning of the debate, encapsulating the opinions of most of the attendees. The conversations of the debates led to a majority conclusion that it was not achievable to do so, despite the desire of senior management to hold and to be held responsible for the career development of their staff. This group of senior managers all recognised that they should have such a programme of investment, but despite their sense of duty, it had been impossible to deliver (although many had invested time and effort in attempting to implement it).

Why? The nature of the role, its immediacy and dynamic nature embedded in the business management function made it very difficult – if not impossible – to outline a defined career path for those entering at VP level, or indeed those directors with ambitions to achieve MD status. Those entering this function have to understand the dynamic. Similarly, the selection of those being brought into the business management function should in no small part be based on their behavioural attributes and the ability to accept that they will have to navigate their own path to success.

As another COO put it:

“This path will often be found within a state of continual flux, unforeseen opportunity and ambiguity. Indeed, to be successful, you will need to be able to thrive in an unstructured environment and understand that career progression and mobility are, in equal measure, resting in your hands to those of your manager; where delivery, patronage and personality will weigh evenly when tipping the scales of opportunity.”

In good times, it was noted, career advancement was not as important, because industry growth offered opportunity and good markets provided excellent financial reward. In more challenging times, however, reduced opportunities for advancement and plateauing compensation caused many to turn their attention to career advancement.

Since 2012 and more so since the 2016 depressed bonus round, upper-quartile talent within business management has been looking more earnestly at the mid to long term, and this is stoking the fire of movement from one bank to another for different reasons. While the market is compressed, opportunities exist, as the COO function manoeuvres itself to meet the demands of the regulatory agenda, control, conduct, governance, front-to-back cost management and transformation.

Traditionally, motivations to move are as follows:

• Compensation.

• Loss of corporate allegiance.

• Direct management issues.

• Career advancement.

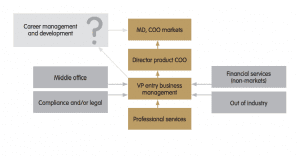

Career management and advancement are now the primary reason for the movement of COOs, and the entry point and the career opportunity are balanced against a feeling that many have found themselves in a career cul-de-sac. Career progression within the COO function – or the lack of it – is an issue for banks. Agreement on this fundamental point led to the question: “If there is no predetermined next step internally (and therefore a list of technical competencies and requirements attached to it), how do you assess someone for entry into the business management function or for promotion once established within it?”

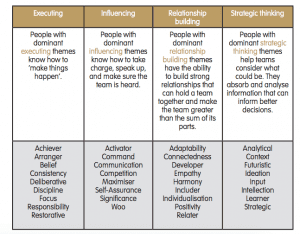

Subject-matter expertise is clearly important, but the debate leaned towards the conclusion that it was not as important as when determining someone’s suitability for other career moves within banking, such as within risk, technology, operations or even as a trader. Behavioural aspects were deemed to be equally, if not more, important when assessing and selecting those entering business management, as these are the skills that help someone navigate their own career, when no defined path is offered. The rising leaders of the COO function are looking for the following in career management:

• Clarity about how they will be assessed and what behavioural characteristics they must demonstrate, and how these will be measured.

• The opportunity to do so, to ‘grandstand’ their efforts, and to stand or fall through their delivery.

COO forum feedback

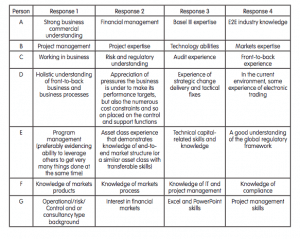

“If limited to four core technical and subject-matter competencies or experiences, what would they be?”

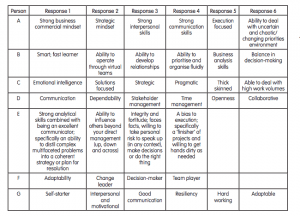

“If limited to six behavioural attributes and competencies, what would they be?”

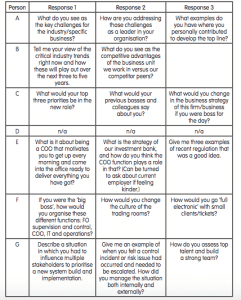

“What are the three questions you would use to assess the suitability of a potential COO hire, whether entry or established?”

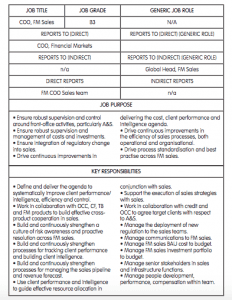

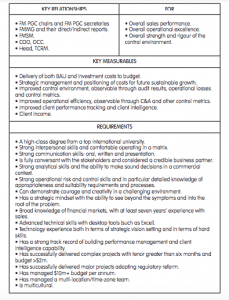

Role description

COO Financial Markets, Wholesale Bank

Role description continued

“Career mobility within business management is a challenge. A centralised model has some advantages for career mobility, but fails to address the key requirements for being an effective COO and therefore where else might they be sourced within a company. I strongly believe that there are many people with a sound appreciation of governance and risk and control agendas who might add considerable value in a COO role, not just from within the current business or business management function. But do these other functions see the COO role as their calling? Will the leadership team in charge of such appointments think laterally and consider talent across the whole firm. Are they prepared to take risks on people, or will they stick to hiring from within the function?”

GLOBAL COO, GEOGRAPHIES, GLOBAL WHOLESALE BANK

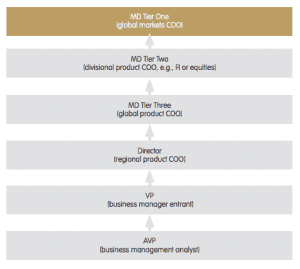

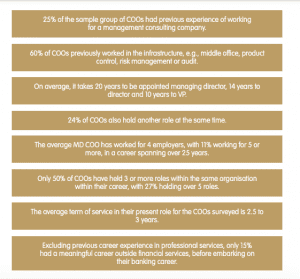

Career progression of the COO

The route to becoming a COO – an analysis of 50 MD COO’s within markets, based in New York or London

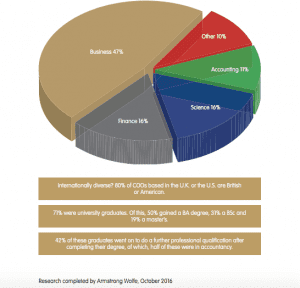

Education, the bedrock of credibility?

The route to becoming a COO

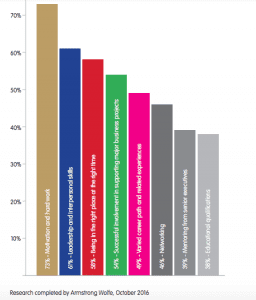

Attributes COOs ‘strongly believe’ were needed for their career development

“When hiring and developing talent within the COO and business management function, it is important to think about what problem you are trying to solve. Banks tend to look for talent within the existing COO team, not externally. That might be okay in a product COO role; an individual might have the required knowledge of key products, but it does not necessarily mean they have broad management experience or an appreciation of the overall management agenda and priorities across the whole firm. These are the areas to focus on when looking to hire the right person – fit for role, not for purpose.”

GLOBAL COO, GEOGRAPHIES, GLOBAL WHOLESALE BANK

Behavioural attributes of the COO

Talent acquisition – VP entry