COO Magazine Q2 2024

The Armstrong Wolfe Event Summary

This quarter, Armstrong Wolfe has come together with the iCOOC membership community to host a range of events that underscore its commitment to leadership, innovation, and inclusivity, all within a Chatham House Rule environment.

We ran dinners and events themed around artificial intelligence (AI), Controls, Risk, Leadership and Performance, Regulatory Change and Operational Resilience, with communities of Chief Operating Officers and Chief Control Officers alike. Furthermore, our Q1 London AI debate, hosted by the London Stock Exchange Group, was a forum for lively discussion and exchange of ideas on how this transformative technology will shape the industry’s trajectory.

In addition to technological discourse, we continue to prioritise diversity, equity, and inclusion (DE&I) through our Ad Centrum initiative, with its first online forum in February looking at Inclusive Recruitment, and our Women in the COO Community (WCOOC) events, aimed at inspiring tomorrow’s female leaders in Financial Services and providing them with a platform to network and debate with other rising stars.

What follows is a broad summary of these Q1 events, and by this we hope to offer insights into the evolving landscape and ongoing discourse within our Membership Community.

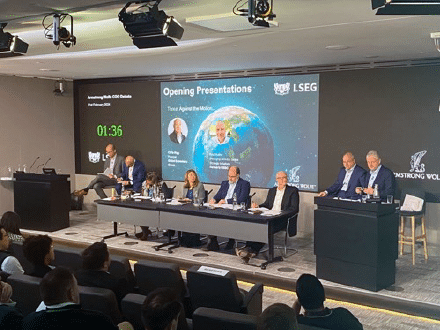

COO Debating Society Q1

21st February 2024. Hosted by LSEG

The Motion: AI presents a greater opportunity than threat to Financial Services

Through debate the society seeks to draw attention to subjects at the heart of the COO’s mandate. The judges and audience are briefed that they can vote based on only the strength of the argument presented, not any predetermined views on the subject. Often both arguments for and against the motion have merit, and a balance is clearly needed for success, but the audience can vote for only one.

The debate is used to break down and present the strengths of each team in its own right, and prompt thought on important aspects of the COO’s day-to-day activities. It affords the debaters the opportunity to take the audience on a nonlinear journey to a result that is not predetermined, as the strength of the argument defines the result.

Debating for the motion: Nabeel Ebrahim (Behavox) and Martin Goodson (Evolution AI) presented compelling arguments highlighting the potential of AI to revolutionise efficiency, risk management, and customer experience.

Debating against the motion: Christopher Rigg (Global Economics Group) and Paul Mullins (Formerly HSBC) offered insightful perspectives on the potential risks associated with AI, such as bias, job displacement, and security vulnerabilities.

CCO Dinner Q1 – New York

27th February 2024. The Yale Club, NYC

The dialogue centred on two main topics: opportunities for automating controls and the current state of electronic and voice surveillance.

Automating Controls: Opportunities & Challenges

Manual Nature and AI Transition

Participants initiated the discussion by acknowledging the overwhelming volume of information that financial institutions must scrutinise and categorise for response, across both the controls and the surveillance environments. They recognised the potential of AI to assist in filtering and identifying the most pertinent information amid the noise.

Control Design & Risk Appetite

Control design emerged as a critical aspect of the conversation: participants stressed the importance of rebuilding control frameworks to ensure their seamless integration throughout the product lifecycle. A discussion on Risk Appetite underscored the prevailing shift towards a zero-risk tolerance stance which is driving material increases in the number of controls, without enough time spent on eliminating ineffective or redundant controls.

Surveillance: Integrating AI and Ethical Considerations

Infrastructure Challenges and Ethical Concerns

The conversation then shifted towards surveillance and the challenges posed by current infrastructure and language models in creating false positives and the practical challenges of integrating AI into existing surveillance systems. Ethical considerations surrounding the implementation of AI in surveillance were also deliberated especially in the context of personal devices.

Participants expressed apprehensions about the inherent lack of explainability in AI systems, and additionally raised concerns about AI being used for nefarious purposes, creating cyber-security threats and spurring the proliferation of deep fakes. Despite these reservations, there was widespread recognition of the potential benefits of AI in identifying improper conduct and proactively monitoring social dynamics to mitigate risks.

COO Dinner Q1 – New York

27th February 2024. The Yale Club, New York City

The dialogue centred on one main topic: opportunities for automating smartly to reduce costs and increase efficiency.

Balancing new business capabilities with resource capacity

Developing strategies for smart cost reduction and efficient use of technology is essential for firms to stay competitive. Leveraging new technologies such as AI and implementing well-considered opportunities for automation can streamline operations, reduce manual effort, and drive significant cost savings. However, it’s crucial to strike a balance between building these improved business capabilities and managing headcount to ensure sustainable growth and continued operational excellence. Collaborating closely with auditors and involving them as partners in the process can foster transparency and accountability while also enhancing the effectiveness of control measures, while also reducing the need to rework processes for audit findings.

Streamlining remediation processes is essential to address any identified issues promptly and effectively. Simplifying these processes not only accelerates corrective actions but also minimizes disruptions to operations. Recognising the collective value of data enrichment efforts across the organization is crucial for maximizing the utility of available data assets. Implementing transactional reporting mechanisms enhances transparency and accountability, facilitating better decision-making and risk management.

Data Challenges

The dialogue on cost reduction and opportunities for automation immediately focussed on the challenges each firm faces in managing the multiple data sets that are used for daily operations (static) or generated by activities that need to be consumed & reported internally or used for external client or regulatory reporting. Participants highlighted the multi-year journeys to simplify data sources, improve governance, are still very much in flight, and while they are anticipated to yield significant savings in run-the-bank (RTB) costs in the long run, they are not there yet.

Role of Jurisdictional Data “Protectionism”

Increasing demand at the jurisdictional level to ringfence local data requires implementing even more complex and robust data governance frameworks. COOs must navigate regulatory requirements and establish clear protocols for data usage and sharing, particularly concerning cross-border data transfers. Periodic testing of these frameworks is essential to enhance the quality and reliability of data sets and to ensure that the data remains a valuable asset that both drives business growth and innovation and can be used in crisis management situations.

COO Dinner Asset and Wealth Management

Q1 New York Dinner

6th March 2024. Grove Street Social, NYC

Dinner Topic: Client Reporting Challenges and Solutions

Client/Data Issues: While client reporting is a concern, it is not the primary driver for business case funding or the root cause of members challenges. The focus should shift to the underlying data, encompassing aspects such as management, architecture, usage, and governance.

Importance of Definitions: Establishing clear ‘client reporting’ v ‘investor’ definitions for fundamental terms (i.e. performance) is essential to ensure alignment across our teams.

Use of Third-Party Solutions and Consultants: Opinions vary; larger organizations tend to develop in-house solutions and recruit the necessary talent, while some organizations rely on third parties for gap analysis, addressing other challenges and providing managed services.

Storytelling for the Executive Committee (EXCO): Crafting a compelling narrative for the EXCO that underscores the significance of generating revenue and solving problems in a cost-effective way are crucial more than ever with today’s macroeconomic environment. Simply saying regulatory doesn’t guarantee funding.

AI as an Enabler: Artificial Intelligence should be regarded as a tool to enhance, not replace, our data management capabilities and human expertise. LLM are viewed as potentially significant from a content crafting perspective.

Governance and Oversight: Implementing an oversight model, such as a product steering committee, is vital for continuous monitoring and performance evaluation of our products. This ensures they meet investment goals and operational standards.

CCO Dinner Q1 – London

26th March 2024. Royal Automobile Club, London.

The discussion among CCOs regarding non-financial operational risks reveals a hierarchy of concerns. Cybersecurity threats emerged as a top priority, highlighting the imperative to safeguard sensitive data against breaches and cyberattacks.

Third-party risk management was a close second, underscoring the need for diligent oversight to avert compliance failures and data breaches in relationships with vendors, suppliers, and partners. Data management and governance also came into focus, emphasising the importance of upholding data integrity, confidentiality, and regulatory compliance amidst evolving privacy regulations.

The other key discussion point was Operational Resilience. Operational Resilience presents a formidable challenge, particularly within highly intricate organisations, where addressing this complexity necessitates a holistic approach. The reliance on third-party services further complicates matters, demanding meticulous oversight to mitigate associated risks effectively.

It’s crucial to align regulators with the day-to-day realities confronted by Chief Control Officers, ensuring regulatory frameworks remain pertinent and adaptable. Data management emerges as a universal concern, with data-related issues increasingly prevalent across industries. Implementing robust data management strategies can be prohibitively expensive, particularly in light of escalating fines from regulatory bodies such as FINRA.

Asserting control over data assets is paramount, underlining the importance of firms owning their data infrastructure and processes. Successfully managing operational resilience demands a concerted effort to comprehend, adapt to, and innovate in response to evolving threats and regulatory requirements.

COO Dinner Q1 – London

27th March 2024. Royal Automobile Club, London.

Focus on Operational Resilience

Digital Operational Resilience Act

The discussion opened by looking at the impact from the Digital Operational Resilience Act (DORA), particularly aimed at banks and financial service providers, which highlights how dynamic and rapidly evolving the regulatory environment continues to be. Participants noted that the diversity of risk appetites and frameworks across firms creates difficulty in developing a common response to regulations. Security risks emerged as a prominent challenge, with the sheer volume of threats demanding heightened attention and innovative approaches.

Cyber Security Capabilities Need

The persistent underappreciation of cybersecurity concerns within the banking and finance sector was also discussed as a major tech risk: a shared sentiment of uncertainty on how to evaluate emerging threats drove a collective desire to be more proactive in anticipating emerging & future challenges, such as the utilisation of AI by threat actors. Participants called for regulatory intervention to impose greater and more coordinated scrutiny on third-party entities, recognising the importance of bolstering security measures across the ecosystem. Moreover, there was a consensus regarding the escalating costs associated with enhancing cybersecurity measures, reflecting the growing financial burden on organisations striving to mitigate technology-related risks effectively.

Private-Public Coordination

It was observed that while the government excels in certain areas of threat management, commercial entities often demonstrate greater agility in addressing emerging risks, although the escalating costs of addressing cyber risks suggest that greater coordination across government and commercial entities would be welcomed: indeed, participants expressed a desire to proactively & collectively tackle emerging risks and bolster operational resilience alongside the public sector.

Ad Centrum Forum – Online

29th Febuary 2024.

Diverse and Inclusive Recruitment strategies

From a practical standpoint, for inclusive hiring to be effective, measures such as diverse shortlists and bias testing become essential, yet frequently insufficient resources are committed to the hiring process, and hence failing to give the necessary time for thorough specification development, extensive interviewing and other measures that can correct biases and ensure a diverse candidate pool. Firms can have extensive controls and processes in place to encourage diverse hiring, but, on a very basic level, if recruitment teams have insufficient time/resources to implement them, as is often the case in a scramble to replace key personnel quickly, then they are null.

Mandatory training for personnel responsible for inclusive hiring can significantly influence hiring managers’ approaches, ensuring a focus on diversity and inclusion (D&I) does not wane under time pressures.

Tactical implementation of diverse shortlists, particularly in senior roles where diversity is scant, alongside pushing back against head-hunters who claim a lack of diverse talent, can significantly impact the diversity of a candidate pool.

Acknowledging and continually challenging biases before, during, and after interviews is critical

Other tools include pooled recruitment, the use of anonymous CVs to avert name bias, providing questions to candidates in advance, diverse interview panels, careful consideration of the language/wording used in advertisements, use of specialist recruitment agencies with a focus on diverse recruitment, using a scoring rubric and looking at different entry points into the profession.

The financial services sector, plagued by a negative image, must broaden its talent outreach to younger individuals and not rely solely on traditional recruitment paths to enhance diversity.

Engaging with a broad spectrum of individuals not only helps in diversifying the talent pool but also brings fresh perspectives and innovative ideas into the industry. A focus on inclusive recruitment is worth the investment of a COOs time and skills, for the benefits of such diverse recruitment are manifold.

It enhances creativity and innovation by bringing together varied perspectives, experiences, and skills, which is crucial for problem-solving and generating new ideas. Furthermore, a diverse workforce is more reflective of the sector’s diverse client base, enabling better understanding and service of clients’ needs.

By actively broadening its talent outreach to include younger, more diverse candidates, the financial services sector can not only improve its public image but also secure a competitive advantage through increased innovation, customer satisfaction, and adaptability to global market changes.

WCOOC In Person Evenings: New York & London

London Event: The Power of your Network. Hosted by TP ICAP.

New York Event: Strategies for Navigating Your Career Path. Hosted by Deutsche Bank.

WCOOC Programme H1 2024

NA Schedule

February 28th

Title: Strategies for Navigating Your Career Path

Host: Deutsche Bank

Panellists: Clement King, Susie Roberts, Nick Hortopan, Kay Lazidis, Sheila Plaisance

April 24th

Title: Mastering Stakeholder Management and Making a Lasting Impact

Host: UBS

Panellists: Clement King, Stephane Xhayet, Lisa Winslow, Danielle Leytaf, Mackenzie Lee

June 20th

Title: Cultivating Your Personal Brand – Strategies for Women in Leadership

Host: TP ICAP (pending confirmation)

Panellists: Clement King, Jeff Schwartzman, Rhiannon Wakefield, Caitlin Behrens, Diana Deems

EMEA Schedule

February 22nd

Title: The Power of your Network

Host: TP ICAP

Panellists: Emma Prophet, Yvonne Waldron, Tom Snowden, Cressida Hamilton

April 18th

Title: Navigating your Career and Embracing Change

Host: BNY Mellon

Panellists: Becky Hewitt, Samantha Alexander, Sophie Rutherford

June 20th

Title: Sustaining Impact and Managing Uncertainty

Host: State Street

Panellists: Sue-Yin Wan, Sophie Rutherford, Natalie Golding, Sam Alexander

APAC Schedule

February 22nd

Title: The Power of your Network

Host: Online

Panellists: Emma Prophet, Katy Matvey, Fatema Bookwala, Melissa Sabella, Sook Yee Cher

April 18th

Title: Navigating your Career and Embracing Change

Host: Online

Panellists: Stiofan De Burca, Dawn Tan, Katy Matvey

June 20th

Title: Sustaining Impact and Managing Uncertainty

Host: Online

Panellists: TBC

Armstrong Wolfe Ad Centrum Online Forum

30th April 2024 8:30-9:30 BST | 15:30-16:30 HKT