Sponsor Perspective

For many institutional investors, the abrupt transition to working from home precipitated by the global pandemic exposed significant gaps in the investment research process—gaps that prevent individual analysts and teams from working as efficiently as possible, and their research from consistently delivering alpha.

Now more than ever, digital transformation and taming the massive growth of unstructured data analysts need to consume—along with the disjointed systems and tools used to organize, protect, and collaborate on research— are top of mind for fund chief information officers, chief operating officers, and portfolio managers.

The ability to understand the challenges businesses face can result in a major upside for buy-side analysts, and technology has emerged as an important indicator of success. At the outset of the Covid-19 pandemic, those organizations using technology that enabled operational teams to collaborate and scale were not only prepared, but they also thrived.

This report from Harvard Business Review Analytic Services couldn’t come at a better time. Advances in cloud computing, artificial intelligence, natural language processing, machine learning, and other technologies are now available to help transform and improve the fundamental research workflow and output to the benefit of both analysts and fund leaders. The needs of one group of stakeholders no longer need to be prioritized over the other.

Set time aside to read through this report, as it will spark the important conversations your team needs to have right now. You’ll learn from fund leaders and business productivity experts about the challenges and inefficiencies of traditional investment research processes and the benefits of a single platform as the place for analysts to do their work every day.

Gaining Competitive Advantage with Investment Research through the Use of Artificial Intelligence and Other Technologies

Information is knowledge, but the crush of unstructured data—basically, any statistics or content not contained in a database of spreadsheets, tables, or other readily scannable formats—can distract organizations from seizing on all the opportunities that research should empower them to take advantage of. For investment funds, hedge funds, family offices, and other asset managers, whose success depends on research that is complete, accurate, and timely, this problem is particularly acute.

For too many investment firms, the research process erects barriers on the road to the achievement of alpha, which are returns in excess of a benchmark. Highly skilled analysts spend precious hours combing through search engines or cutting and pasting text or graphs from research reports. Internal communications suffer as analysts and portfolio managers search for insights buried in email trails or hard-to-access files. In other words, too much time and effort are being used on organizing the information needed to analyze ways to achieve alpha rather than on the analysis itself.

“It really comes down to a competitive landscape of not just how fast can you access information but how fast can you process information?” says Eric Marshall, president and co-chief investment officer at Dallas-based Hodges Capital Management.

Vast quantities of text and data must be quickly gathered, organized, and distilled into an investment thesis, often no more than a paragraph, containing actionable views on why a company does or doesn’t warrant a place in the firm’s investment strategy. It is a process that advances in artificial intelligence (AI) and cloud computing can help with, but the investment community can be slow to adopt new technologies. A 2019 CFA Institute study showed that just 10% of portfolio managers had used AI and machine learning within the previous year to help their investment process, and just 8% used them to identify key factors driving markets.1

Yet the Covid-19 pandemic, by intensifying and highlighting many of these challenges, is awakening investment managers to the need for new technologies and approaches. “There’s now an expectation that all sorts of business services are available in the cloud, from anywhere, at any time,” says Hossein Ghodse, chief technology officer for Ardevora Asset Management, based in London. “That’s almost the business norm now. I think probably Covid has accelerated that and forced the issue for some firms that were maybe more reluctant or anxious” about adopting cloud computing.

This paper examines the problem the crush of information poses and the roles that cloud computing, AI, machine learning, natural language processing (NLP), and systems that organize information, streamline workflows, and improve collaboration will play in solving it. The paper also discusses best practices executives need to know when bringing their organizations on this journey.

The Twin Challenges: Overload and Inefficiency

Managing today’s vast information flow challenges all professions and industries. According to a survey by Harvard Business Review Analytic Services in November 2019, 82% of respondents reported that exploring, understanding, and using unstructured information is a “significant challenge” for their company, and 77% said they continue to sort and organize unstructured information manually.2

For investment firms, the crush is intensified by regulatory and other filings required of many corporations. The Securities and Exchange Commission (SEC) alone processes some 3,000 filings per day and generates an annual 3,000 terabytes of information in the form of 10-Ks, 10-Qs, 8-Ks, prospectuses, and other public documents.3 Industry-specific information abounds; a single online database covering North American manufacturing features 300,000 articles and white papers and tracks 500,000 suppliers and more than six million products.4 And that’s just for starters.

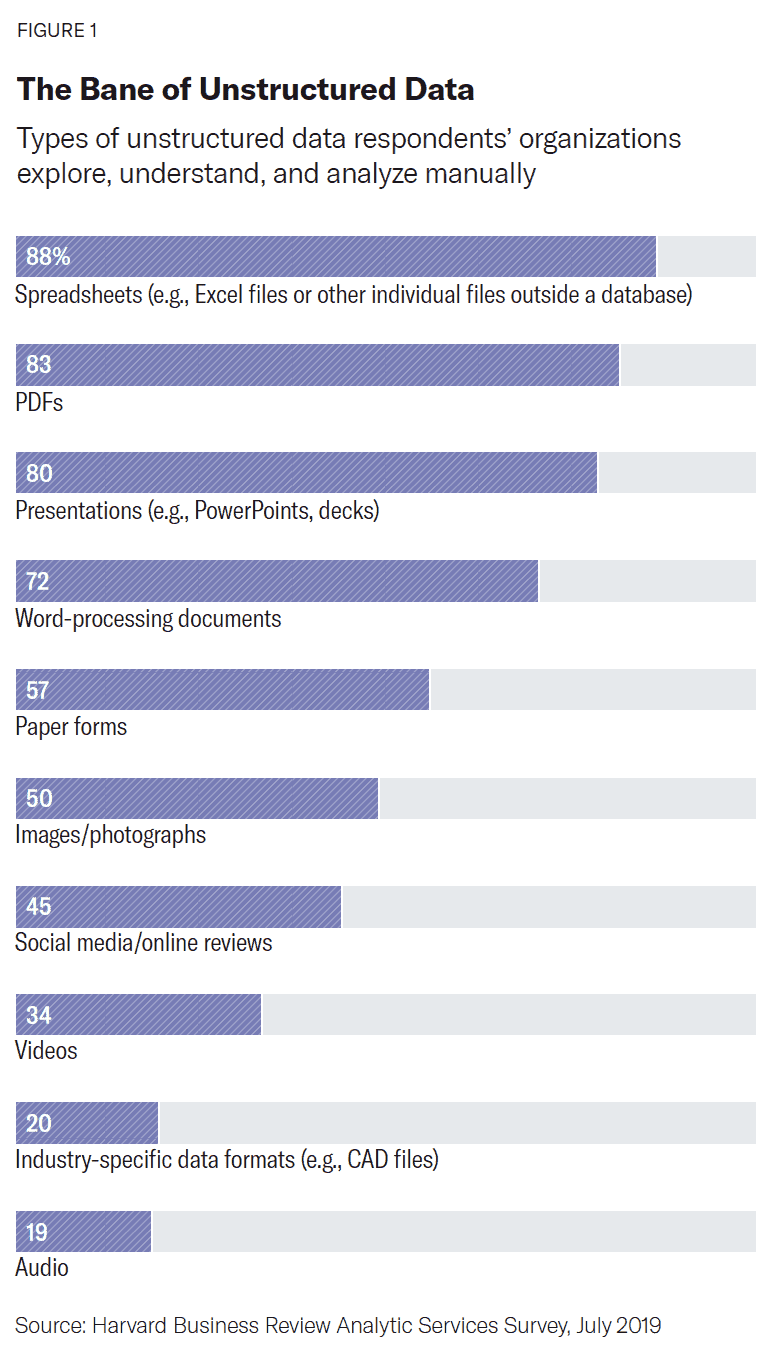

Indeed, most of the information coming at analysts these days is unstructured, arriving in a vast multiplicity of forms that include spreadsheets that live outside databases, PDFs of research papers, word processing documents, social media posts, videos, and audio transcripts. Eighty-eight percent of respondents to a July 2019 survey by Harvard Business Review Analytic Services said spreadsheets involving files outside a database are the type of unstructured data that their organizations explore, understand, and analyze manually, as are PDFs (83%) and presentations such as PowerPoints and decks (80%). FIGURE 1

“There’s now an expectation that all sorts of business services are available in the cloud, from anywhere, at any time.”

Hossein Ghodse, Chief Technology Officer for Ardevora Asset Management, London

In the investment world, analysts do their best to manage the flow by remaining constantly vigilant across any number of portals, from news and financial websites to data terminals, search engines, and email inboxes, darting from one platform to the next. In the absence of a dedicated system or a single platform, analysts cobble together their own methods for tracking developments, storing key documents, or communicating with peers, says Ghodse of Ardevora Asset Management. “People do that because they intuitively know they need to systematize.”

Yet the cost in time and money is considerable, and information inevitably falls between the cracks. “They end up spending huge amounts of their time, well-paid time, just organizing and structuring data,” Ghodse says of analysts and others in the investment world. “It’s certainly not value-adding in terms of their ability to pick good investments.”

Consider the fact that information gaps create the investment inefficiencies that can set the active managers at Hodges Capital apart from passively managed exchange-traded funds and index-based mutual funds when seeking alpha for customers. By painting hundreds of companies with the same broad brush, exchange-traded funds and index-based mutual funds create opportunities for 15 skilled analysts at Hodges Capital to “go in and really uncover what’s going on in those businesses and decipher the reality versus the perception,” says the firm’s Marshall. “That’s where you find alpha.”

So, think about that Hodges Capital analyst or any other at an investment firm working hard and fast to put together an investment thesis and then suddenly being pulled from the thought process by a frustrating and fruitless search for an old email. Constant interruptions contribute to what Rob Cross, Edward A. Madden Professor of Global Leadership at Babson College, refers to as “micro stresses”—seemingly small interruptions, inefficiencies, and irritations that can add up to big costs in terms of a skilled worker’s happiness and productivity. “Cognitive psychologists showed that if you just look down at a text and back up, it’s something like a 64-second recovery in your thought process. If you allow that disruption to be sufficient that you lose your train of thought,” he adds, “that can be up to 23 minutes to get back to where you were.”

Emails aren’t the only form of collaborative content that lead to micro stresses. “Collaboration overload” results when individuals communicate through a constant barrage of emails, attachments, instant messages, and remote video meetings, says Cross, author of the forthcoming Beyond Collaboration Overload: How to Work Smarter, Get Ahead, and Restore Your Well-Being. “It’s gotten even worse through Covid,” he says. “Generally, what we’re seeing is people are spending about five to eight hours more a week engaged in collaborative work, and it’s much more fractured time.”

Eighty-two percent of respondents reported that exploring, understanding, and using unstructured information is a “significant challenge” for their company, and 77% said they continue to sort and organize unstructured information manually.

Solving the Information Crush

Just as technology has helped create overload, advances in AI, machine learning, and NLP hold answers to better and faster research, organization, efficiency, and results. These advances are making it possible for computers to make the leap from structured to unstructured information, detect and interpret nuances in written reports and human conversations, and deliver informed analysis through a single platform. And greater adoption of cloud computing helps ensure that any essential member of a team can access that information from anywhere.

One of the great challenges for computers has been parsing the ambiguities and multiple meanings of language, an area known as semantic analysis. Consider the multiple synonyms for the words “profits” and “margins”—Thesaurus.com offers 45 and 30, respectively. To help an analyst looking into same-store results for, say, a restaurant chain, a computer must be able to locate, compare, and select useful financial documents while at the same time weeding out volumes of excess noise.

Thanks to machine learning and NLP, computers are increasingly adept at recognizing how words are used in various combinations (or “ngrams”) that drive toward specific meanings, says Mike Teodorescu, assistant professor of information systems at Boston College’s Carroll School of Management. Armed with sophisticated algorithms, “You can essentially look at which words are frequently used together, or not, in term-frequency vectors that are machine readable.” In this case, the computer learns to home in on vectors combining “profits” and “margins” with “same restaurant,” “comparable restaurant sales,” or other relevant terms.

Likewise, with something called topic modeling, computers scan thousands of words in a document or a set of documents to identify broader topics of interest to analysts. “Now you can take a huge amount of information and narrow down your search space to only a few documents,” Teodorescu says. “And you can tweak the algorithms to show you more documents or fewer documents, depending on what you’re interested in.”

With named entity recognition, meanwhile, computers can report on individual executives, key employees, or research scientists who move from one job to another, potentially altering the prospects for those companies, Teodorescu says. Each new capability presents hurdles for the technology to surmount, he notes. With named entity recognition, for example, variations such as formal and informal first names, middle initials, and misspellings all create potential tripping points that computers must learn to overcome.

Yet as the technology continues to advance, computers are rapidly moving beyond collecting and delivering information to offering new insights analysts might not have found on their own. With so-called sentiment analysis, for example, computers capture and assess opinions people are expressing about a given company, product, or issue. Say, for example, you want to know how well or poorly a specific company responded to supply chain pressures that disrupted industry after industry during the pandemic. Using sentiment analysis, you could see what that company’s executives have been saying about the overall health of its supply chain, and about key business drivers such as pricing, revenue, gross margins, or raw material expenses. As a reality check, you could see what the company was saying about these subjects prior to Covid-19, hear what outside analysts are saying, call up side-by-side commentary from as many or as few competitors as you want, or even track sentiments rippling across the entire industry or sector.

While such tools can’t replace the thoughts, decision making, or thesis writing of skilled human analysts, their value is manifest, Ghodse says. Ardevora’s investment approach uses cognitive psychology to find and exploit market inefficiencies driven by investor emotions such as overconfidence or fear. Says Ghodse: “Any data that augments analysts’ own thinking on this, or simply provides validation about ‘market sentiment,’ is a useful tool.”

In addition to textual information, AI is helping analysts manage swarms of numerical data as well, finding the most relevant numbers, comparing a company’s current results with past figures or with the competition, and identifying trends the numbers reveal—presented in easy-to-visualize tables and charts.

Instead of the analyst copying and pasting data points or creating ad hoc spreadsheets, the computer quickly searches, locates, and calls up comparable numbers from multiple SEC filings, inserts fourth-quarter results into a table, or conducts year-on-year or quarter-on-quarter calculations. All of which means the findings move that much faster from the analyst’s desktop into a timely investment thesis.

Toward Better Workflows

As sophisticated as the technology becomes, among the most important developments in AI, machine learning, and NLP is ease of use. As business applications become more streamlined, companies are gaining the benefits of complex algorithms and putting the information to work without hiring phalanxes of AI specialists or even “knowing how it works under the hood,” Boston College’s Teodorescu notes.

The same imperatives apply to workflow management. To add value, systems must be easy to use and must enhance collaboration by storing and displaying information for ready access by all key team members.

At Hodges Capital, analysts in the past would send investment theses to portfolio managers via email. Later, if a company popped up on the firm’s radar and a portfolio manager suddenly needed background, that investment thesis might be a dim memory. “Frankly, six months later, people forgot about that email,” Marshall says. The same applied to daily notes analysts took based on meetings and calls. “A lot of this stuff just kind of lived somewhere on our server, which everybody had access to, but you didn’t have a way to search or aggregate.”

Today, Hodges Capital uses a system that curates all the firm’s information, from analysts’ notes and theses to numbers-filled company presentations and AI-assisted research findings, on a single platform. The information is stored and easily retrievable by all members of the team. That accessibility means Marshall, as research director, doesn’t have to interrupt his analysts with calls or emails to check their progress. Because the analysts’ research notes flow directly into the shared system, “I can see in real time the workflow of my investment team,” he says. And when team members work remotely or travel on business, secure cloud computing enables them to retrieve the information from laptops or mobile devices. Covid-19, of course, has accelerated the need for that level of connectivity.

In fact, cloud computing is likely to assume an even larger role when it comes to organizing and storing data. In direct response to the pandemic, 30% of businesses across industries will accelerate spending on cloud computing, security and risk, and other features in 2021, according to Forrester.5 And a Harvard Business School Analytic Services report in January 2021 identified cloud computing as the top digital priority for the financial services industry in responding to the pandemic.6

To add value, systems must be easy to use and enhance collaboration by storing and displaying information for ready access by all key team members.

Generating, Preserving, and Protecting Priceless Information

In addition to the efficiencies it creates, Ghodse believes his firm’s single-platform system and standardized ways of organizing, storing, and sharing information lead to better thinking and a higher quality of investment thesis. Say, for example, the firm analyzes two companies in the same sector. If one thesis is enthusiastic and the second lukewarm, Ardevora must be certain the results reflect qualitative differences between the two companies rather than inconsistencies in research or communication. “If you don’t systematize things, then you have a much higher degree of variation in how you apply a process,” Ghodse says. “That variation actually leads to inconsistency and entire opportunities that we would miss, or, potentially, decisions that we would get wrong.”

Over time, a firm’s investment perspectives comprise one of its most valuable assets, intellectual property, and are a key driver of its unique selling proposition (USP)—the special mix that differentiates a firm or a fund from the competition. “Just think about it purely from an information management perspective, having it all in one place, with the relationships between the data defined and articulated and shared and commonly understood across the firm,” Ghodse says. “That absolutely means that you’re maintaining that USP.”

Another key consideration in a highly regulated industry is record keeping and compliance, Marshall notes. “If somebody comes in and says, ‘What did you know? When did you know it? Why did you buy this stock?,’ we have everything documented,” he says. Likewise, if Hodges Capital votes for or against the management in a proxy contest, the system keeps a full record of the thinking behind the decision. “If someone came back five years later and said, ‘Why did you vote this way in this proxy?,’ we have it all recorded right there.”

Best Practices for Implementing Technologies

Investment firms shouldn’t start using AI just for the sake of doing so. Carelessly implemented, AI may simply add to disorganization and overload, or even unintentionally reflect and perpetuate cultural biases and stereotypes, Teodorescu says.

“A more careful approach is better here,” he says. “So, it’s good to have an understanding of the organization, its needs, and the skill sets of the people who use the tools.” Before investing in new systems, firms should clearly understand the problems they are seeking to address and the delays and inefficiencies that are resulting in missed opportunities so they can ensure the solutions will address those issues.

Yet the need for care must not be a rationalization for delay or failure to adopt more efficient workflows and the technology needed to support them. Firms that stick with the familiar out of comfort may steadily lose ground. And those that use in-house-only servers and software out of historical security concerns may be overlooking the real security risks of their on-premises systems while denying themselves the scope, reach, and flexibility of secure cloud systems with advanced authentication and encryption protocols, climate control, uninterruptible power supply (UPS), and other security measures. Another risk: adopting new systems without a concerted change management strategy to prepare the team.

In direct response to the pandemic, 30% of businesses across industries will accelerate spending on cloud computing, security and risk, and other features in 2021, according to Forrester.5

Part of that process should include communicating the reasons for the change with every team member who will be affected, Ghodse suggests. “I would certainly spend time with the users explaining, ‘This is what we’re thinking of doing and why. And by the way, don’t worry, this isn’t intended to replace your jobs. It’s intended to allow you to focus more time on these more interesting things over here. Here are the opportunities. Here are the ways these tools can augment what you do.’”

Rather than rolling out a new system and expecting everyone to climb on board, firms should consider enlisting a handful of their most respected producers as “early adopters,” Babson’s Cross suggests. “You can have a 25% to 30% greater uptake of the application working that way than if you just cascade it through the formal structure.”

At Hodges Capital, one early mission was to break members of the investment team—ranging in age from their 20s to their 60s—of the ingrained and often reflexive habit of firing off emails, and to teach them to rely instead on the notes system to capture and preserve ideas. But that edict was just the start. After initial training sessions, the firm conducts regular retraining to make sure team members stay up to date with the technology as it evolves and to ensure that new hires adopt the system seamlessly.

Before investing in new systems, firms should clearly understand the problems they are seeking to address and the delays and inefficiencies that are resulting in missed opportunities so they can ensure the solutions will address those issues.

Conclusion

While adopting new technologies and efficiencies requires a commitment of time and resources, the risks of staying wedded to traditional systems seem even clearer. One thing is certain: the pace and volume of information facing investment firms and individual analysts are only going to escalate in the years to come.

That proliferation, in turn, raises the stakes and the need to eliminate busywork, help analysts better understand the information coming at them, and move faster toward informed decision making. “Alpha is [about] outperforming the market. Ultimately, it’s how we are judged,” Ghodse says. “Information is really valuable if you’re the first person to have it. And if you’re the hundredth person to have it, it’s much less valuable.”

Marshall predicts such technologies will soon be as ubiquitous among investment teams as customer relationship management (CRM) systems have become for sales organizations. “When CRM came on the scene, people didn’t think that they needed it,” Marshall says. “Now their whole business operates on it, and they wonder, ‘How did we operate without it?’”

Naman Shah

President, Sentieo

Highlights

For too many investment firms, the research process erects barriers on the road to the achievement of alpha, which are returns in excess of a benchmark. Highly skilled analysts spend precious hours combing through search engines or cutting and pasting text or graphs from research reports.

Just as technology has helped create overload, advances in artificial intelligence, machine learning, and natural language processing hold answers to better and faster research, organization, efficiency, and results.

Before investing in new systems, firms should clearly understand the problems they are seeking to address and the delays and inefficiencies that are resulting in missed opportunities and ensure the solutions will address those issues.

Endnotes

1 CFA Institute, “AI Pioneers in Investment Management,” 2019. https://www.cfainstitute.org/-/media/documents/survey/AI-Pioneers-in-Investment-Management.ashx.

2 Harvard Business Review Analytic Services, “Knowledge Mining: The Next Wave of Artificial Intelligence-Led Transformation,” 2019. https://hbr.org/resources/pdfs/comm/microsoft/knowledgemining.pdf.

3 U.S. Securities and Exchange Commission, “About Edgar,” https://www.sec.gov/edgar/about.

4 Thomasnet, https://www.thomasnet.com.

5 Forrester Research, “Predictions 2021: Accelerating out of the crisis,” 2020. https://go.forrester.com/wp-content/uploads/2020/10/ Forrester_Predictions_2021.pdf.

6 Harvard Business Review Analytic Services, “5 Industries, 5 Strategies for Digital Resilience,” January 25, 2021. https://hbr.org/ sponsored/2021/01/5-industries-5-strategies-for-digital-resilience-infographic.