What does the COO Asset Management’s profile look like?

The overwhelming commonality is the evolving consensus that the global COO is geographically located in relation to the value of assets under management globally; that the role of the COO requires an innovation mindset; and evidence suggests that you are just as likely to reach this position if you have remained with one asset manager, moved between multiple or had experience within other industries.

A difference between the tenure of a Markets COO compared to an Asset Management COO, is that a Markets COO would have tended to have more organisational moves than their peers in Asset Management.

Indeed, it is not unusual to find within asset management that the Global COO joined their company at entry level. Conversely, there are examples in asset management where a Global COO has been appointed from the external market, which is extremely unlikely to be found within markets.

It is widely recognised that the industry has some distance to travel if it is going to be truly representative of the societies it serves.

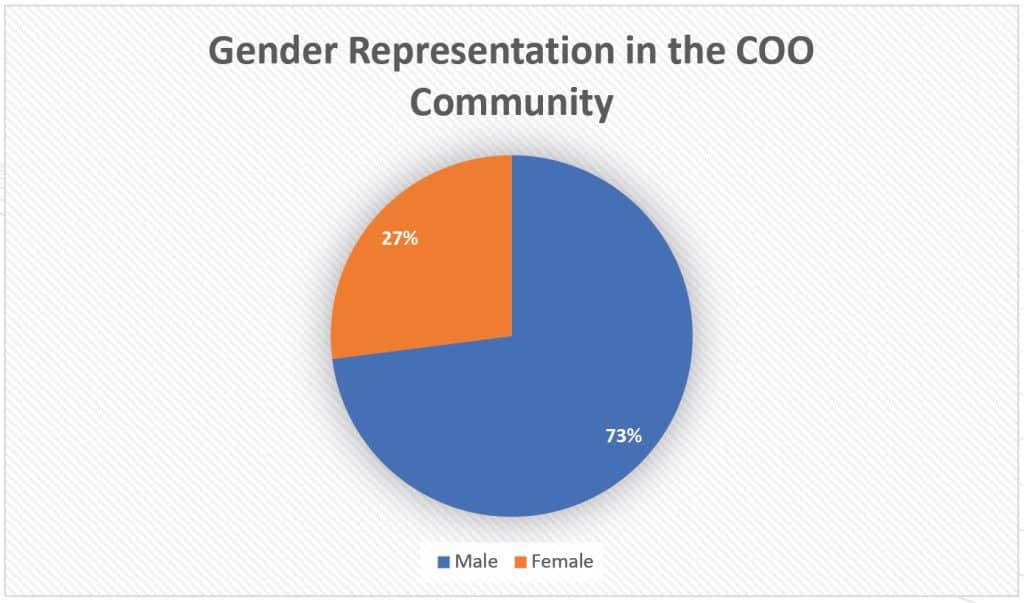

Our analysis shows that less than approximately 90% of the global COO community are white Caucasian, and only 27% of the community are women. This is similar to the Markets COO community, as 94% of this population are white Caucasian, and 33% are women.

Workplace Location and Global Distribution

50% of the Global COOs in the sample are based in North America, reflecting its status as the hub to the world’s asset management community (by assets under management).

Within the parameters of the organisations researched, the remaining 50% are based in EMEA, the world’s second largest asset management region. Notably, none of the Global COOs sampled are based in APAC, perhaps reflecting its status of sharing less than 20% of the value of AuM globally. However, the region is forecast to outpace EMEA and North America in growth of AuM in the next five years, and COOs may relocate on this basis.

Nationality & Ethnicity Distribution

Two thirds of the global COOs in the sample are British or American (with an equal split between the two).

Gender Representation

As noted, only 27% of Global COOs in the sample are women. The talent pool of experienced women in asset management is small and is reflected at lower levels. Citywire’s 2022 Alpha Female Report notes that just 12% of the 17,500 portfolio managers on their database are women. Akin to many other industries such as technology and engineering, whilst there are arguably equal opportunities for women to enter asset management, the asset management community is presently failing to make careers within it attractive to female talent. Until it addresses this issue, there will always be a shortfall in representation of women at the executive table.

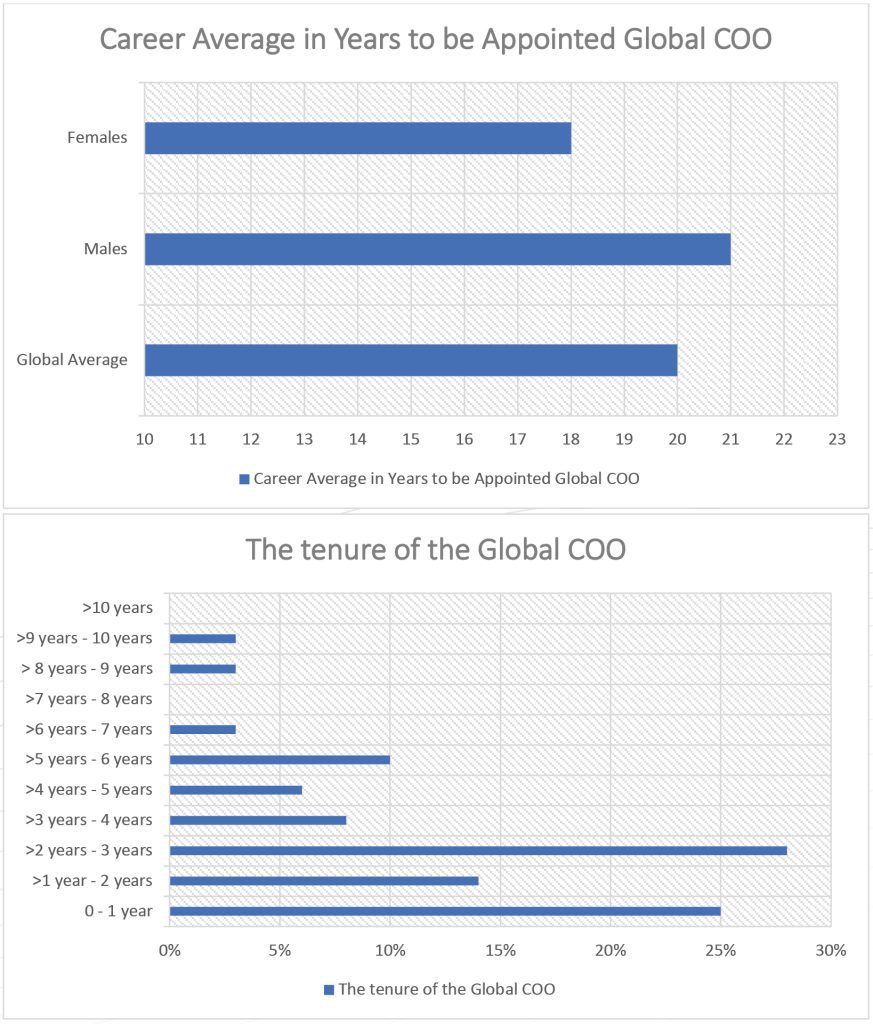

Career Average & COO Tenure

Career average in years to being appointed current position as Global COO and length of time in the role.

On average, it takes 20 years to be appointed as a global COO, although this journey is shorter for women (18 years), and longer for men (21 years).

In only one case was a global COO appointed not from the asset management industry. Those with experience in other industries (e.g governmental affairs, law, management consultancies, and academia); tend to reach the global COO position a lot more quickly (5-11 years) than those with just asset management experience. This suggests that a diversity in industry experience enriches a person’s capabilities, which is a recognised attribute for being an effective COO.

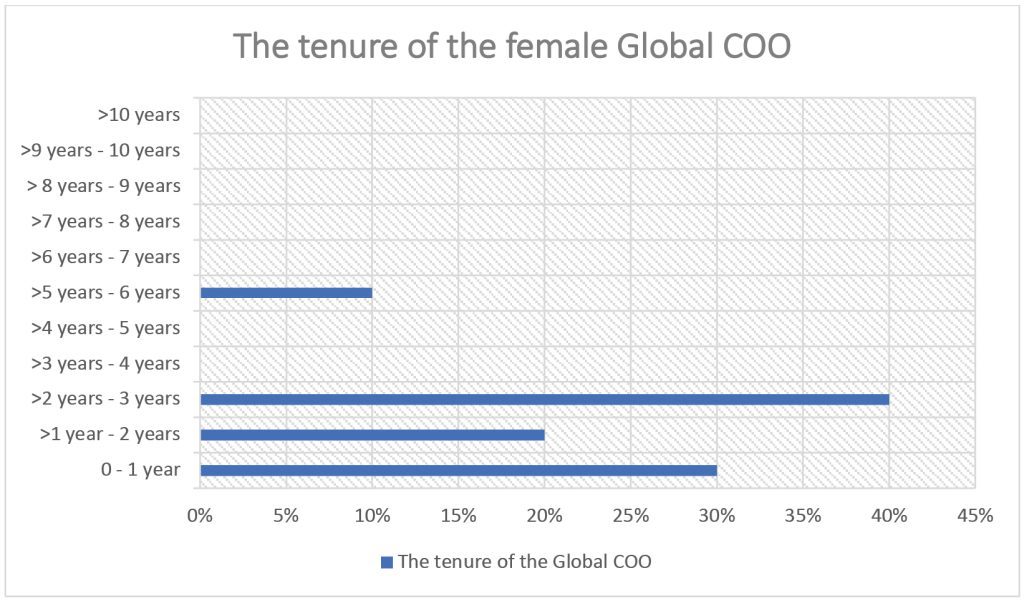

There are of course exceptions to the above, where exceptional people have risen to the position of Global COO from within a single company, or just drawing upon asset management experience. More than 80% of the global COOs have been in their positions for less than five years (25% for less than a year) and only 6% have remained in their position for more than eight years. You could argue an industry-wide focus on diversity has had a necessary impact, as 90% of the female global COOs have been appointed in the last three years.

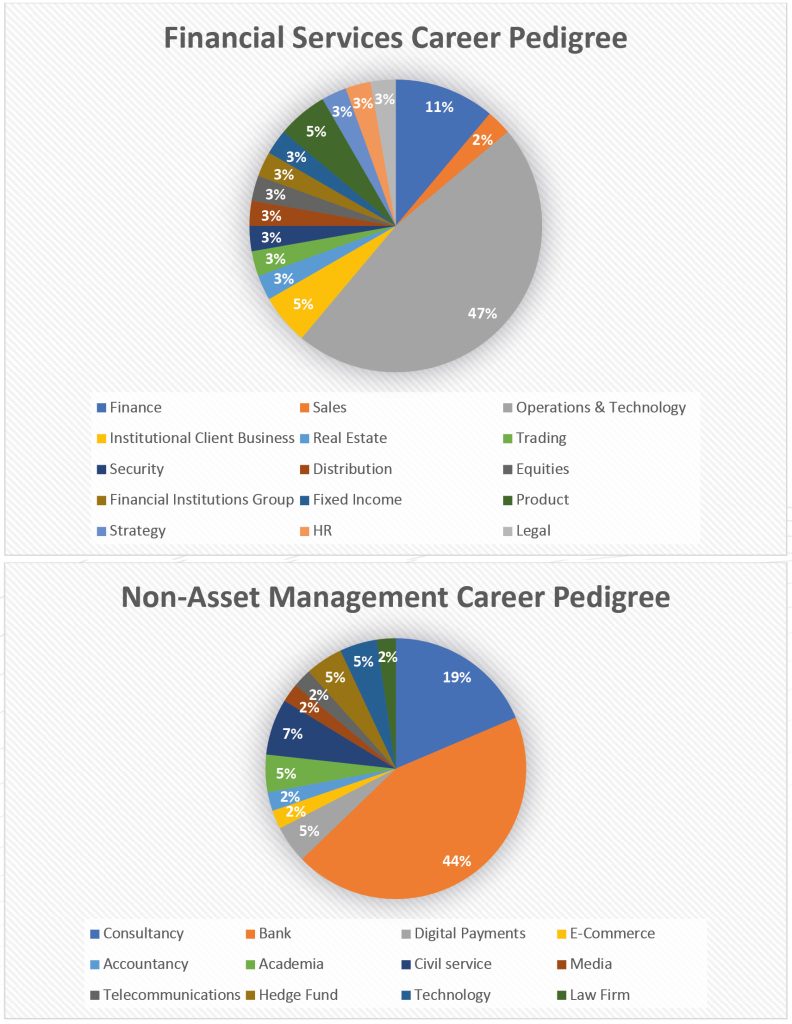

Career & COO Pedigree

55% of the global COOs come from a technology, transformation and/or consulting background, which directly reflects the shift in the role of the COO as an agent of change and transformation. In parallel to the current profile of the COO, BNP Paribas’ 2020 report ‘The Future COO’ noted 59% of asset managers saw delivering change and transformation as a key priority in future. Therefore, the market representation of 55% coming from this background reconciles against the data from BNP Paribas.

Be it by design or accident, there is an additional theme emerging where a reasonable percentage of the population sampled have had buy- and sell-side experience within their careers. Having experience on both sides of the same coin has multiple advantages, although a number of those who have undertaken this migration have found the cultural change from financial markets to asset management somewhat challenging.

A look forward

Where next for the global COO?

Historically, being appointed a Global COO has been seen as the end of the journey, as opposed to a stepping-stone to the next phase of your career. This statement is specifically relevant to financial markets, where the promotion of a Global COO to either Deputy CEO, running a region or being the Global CEO is not a path well-trodden. Within markets, the COO role can be become a cul-de-sac of opportunities.

This however is somewhat different in asset management, where 23% of the global CEOs from the sample were promoted from the COO role into the business. As the sector continues to face a multitude of disruptions in 2023 and beyond, the COO is key to advancing operational resiliency and designing and executing transformation. These responsibilities in turn create an executive pipeline for an asset manager to draw on to lead the business.