Jeff Fernandez

Jeff brings significant Financial Services experience within managing FO businesses, Asset Mgmt., Custody Services, Global Ops. and has held leadership roles with Barclays, Lehman, and Goldman Sachs. His skill-set spans line mgmt., reg. programs, strategic planning, execution and deployment and global project mgmt.

With Barclays, as MD Markets Risk and Controls, Jeff led the first line of defense responsible for Market’s Supervisory Framework, Governance, Volcker and Swap Dealer Programs, 3rd Party Venues, Financial Crime and Markets India Front Office Services. Jeff has experienced two long-term international assignments with both Lehman and GS.

Larry List

During his career Larry has served in senior COO roles primarily within global banking organisations. Presently Larry is serving as an industry strategic advisor to VoxSmart, a fast growing RegTech company delivering advanced conduct surveillance technology and regulatory solutions. Previously Larry served as the Chief Conduct and Controls Officer for Global Markets Americas at BNP Paribas. He was also the regional COO for Commerzbank, where he led the integration of Commerzbank and Dresdner Bank in the U.S. He has held senior positions at Dresdner Bank, originally joining as part of the management team starting a US Equities division.

He also was the COO for DKR Oasis, a multi-strategy hedge fund.

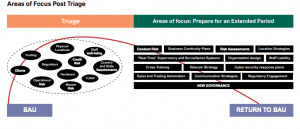

The entire Financial Services industry is in triage mode, whether you are in the wholesale markets, asset management, financial market utilities, and/or exchanges.

For sure each industry segment and company has its unique challenges specific to its business activities, and companies will need to evaluate and address idiosyncratic risks.

More broadly, however, there is a stark realization that many firms have underestimated the challenges of operating in a global market, with massive co-dependencies and risks. Why is this the case? (We will discuss this aspect on our next series.) But for now, the clear consensus among COOs is that the industry needs to significantly adapt to the new normal, which is just starting to be defined. And COOs will undoubtedly lead the effort on behalf of senior management, which will include a broad array of topics that require strategic and operational analyses and decisions, combined with significant implementation challenges.

What does the new normal look like? What are the key themes that require a rethink, and likely a major re-engineering?

Areas of focus will include the following:

Business Continuity Plans and Cyber security response plans

The regulators have already initiated horizontal reviews of banks on cyber plans, which require significant enhancements across the industry. How are you able to recreate start or mid-day positions? How to connect to market centers for trading, clearing and settlement in non-standard, alternative processes? How quickly can systems really recover in a practical event? Do you have comprehensive testing and scenario planning? Management will need to convince themselves of the robustness of their recovery programs, rather than a “tick the box” exercise. Aspects such as reliance on affiliates, reliance on third parties, and scope of teams to be prioritized are all to be looked at. And to be clear, these topics must be addressed through a global lens.

Telecom strategies need to be reevaluated. BYOD is likely to change or in fact end, private network strategies, recording all need to be addressed. Most importantly, the regulatory and conduct standards established will need to be applied to new virtual channels being used for remote working. Firms will need to make judgements on how they will allow these newer channels to be utilized, and by whom.

Automation will accelerate, especially around sales and trading. Exchanges would not function, including market making responsibilities, without advanced electronic capabilities. Scaling reduced human intervention not only is cost efficient, but also restricts undesirable behaviours which minimizes conduct risks. Automation is about controls as much as efficiencies.

Location strategies must be on the table for evaluation. Shared space and remote working can potentially represent a major cost savings opportunity, which will help defray new expenses to be realized in the adaptation. Previously sales and trading roles could not be done in remote centers or WFH, as this was “taboo” to control behavioural risks. Now the world has changed, and it is inconceivable to not have at least a core function established remotely for sales and trading on a permanent basis.

New governance will be needed. BCP and cyber are business problems, and leaders can no longer keep these programs in the “back end”.

Expertise must be brought in with specialized knowledge, in order to make strong, meaningful recommendations informing organizational and infrastructure design.

Firms will need to invest in “real time” supervisory and surveillance systems. Electronically capturing what is actually occurring and enabling surveillance and documentation is critical. Piecemeal and manual processes will simply not be sufficient going forward. While the regulators understand the current situation, they also will expect proactive advancements once the initial crisis is under control. And know that this topic is evaluated across the industry so firms will ultimately need to be in line with best practices.

Risk Assessments will continue to be elevated in criticality. Assessing all the new risks, remediation planning, and establishing more formal operational risk decision processes will be a key ask from management, regulators, and shareholders.

Organizational Design and Cross Training needs re-evaluation. Over time and largely due to resource constraints, key managers and staff are expected to do it all – execute the BAU, implement new regulatory programs, respond to inquiries, develop forward strategies, and many others. Increased specialization of staff assigned to all these challenges will need to evolve, to enable better decision making on investments, business processes, and implementation risks. For example, a key area that will require organizational redesign is IT. IT departments must ensure they can remotely administer complex trading and processing systems, support automated strategies development, execute systems recovery and many others, all addressed with clear departmental roles and responsibilities.

Regarding cross trading, management can consider to group “like” functions, minimize silos and ensure critical mass for all functions across many scenarios. Department partnering is an option. The “whole” must operate, not just certain components. Siloed management and specific incentives do not generally promote this thinking, so management should take a step back and create new incentives to adapt.

Communication Strategies also need to be revised. Most banks struggle to effectively communicate and instruct staff in crises.

Finally, regulators need to change their approach. The current approach of asking questions and “monitoring” is not sufficient. Regulators must also adapt a more progressive and proactive approach. The market-side of the regulatory construct has now seen this twice, for example implementing extraordinary measures in promoting liquidity and funding to help prevent catastrophic market moves. The supervisory side of the regulators have not operated in the same way, so this paradigm shift is encouraged.